Loan Calculator Mortgage Assist

A House is usually bought by Individuals by taking a mortgage out. A loan is. But before going in to get financing, it is very important to consider the options and discover what’s out there. One to consider is the installment amount. An installation speed that is top is a dangerous item. In the period of unrest of today, an individual could be bankrupted by it and cause the reduction of the house. These numbers can be evaluated with no hassle and easily. This limitations and assists an individual to borrow inside his ability.

The Calculator

A Loan calculator is something which is used to find the payments which would be caused by a mortgage out. Calculators are available in many forms. You will find ways for finding out the monthly mortgage course and you will find calculators to discover the rates of interest on the loans, current cash flow, present spending, retirement saving, etc. All these Calculators get ready for the long run and make it effortless for an individual to budget. They are in planning save or how to invest the earning helpers. Calculations on newspaper can become tiresome and there are opportunities of making a mistake. This Where calculators be convenient is. Sites supplies calculators and the consumer must do in fill in the boxes and then click on the calculate button. For calculating the loan sum before going in, it is vital to comprehend the type of attention possibilities out there. Loans are offered on fixed or varying interest rates.

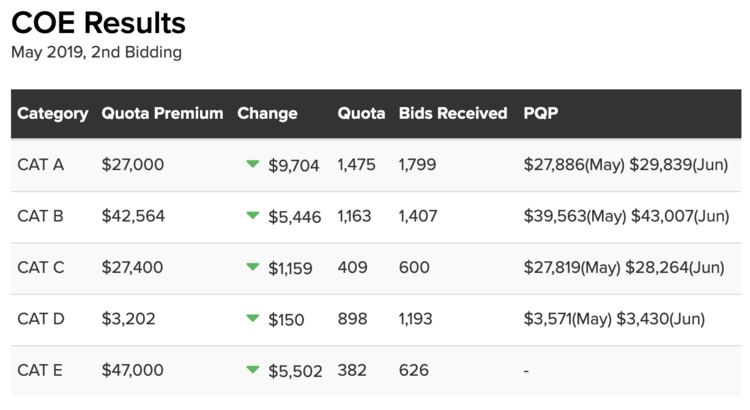

This Also impacts the calculation of the obligations. That the calculation could fail whether this distinction is not known. For A latest coe bidding results would be the amount of years of loan the mortgage amount and the rate of interest. An individual gets in the loan calculator mortgage sum per annum and monthly in addition to the interest per annum monthly after the button has been clicked. This functions as a loan calculator also. A Loan calculator that is Fantastic computes the interest and loan but also features an alternative between the worth of financiers an at a glance look in the gap in repayment prices. This makes it easier to pick the most inexpensive and best alternative. There are also.

The Calculator functions as a guide. Whether the advice given by the lender is accurate, they could check. Seeking the support of a financial adviser is always a fantastic idea and should not be put off because a fantastic speed was given by the loan. With loan calculator mortgage choices are a lot more easy to get refinancing an older one or for a loan. With just a bit of assistance from calculators that are internet and a financial adviser, obtaining the best bargain on mortgages is a done deal.