Various types of personal loans

Cash consistently assumes the most significant job in human lives. The craving to satisfy individual needs strike a chord yet managing for that is not generally conceivable. Yet, in a nation like India, that cannot be a boundary to satisfy your and your family’s wants. Since, there are many banks and other money related associations in the nation who give credits to individual reasons. These sorts of credits are known as close to home advances. India is arranging on one of the top situations as far as giving these sorts of credits.

Individual credits are just those retail advances which are accommodated the motivation behind satisfaction of individual needs and costs of people forthcoming advance borrowers. The individual advances in India basically are given under five significant classifications. In spite of the fact that the credit sum and the pace of premium change from bank to bank, however the motivations behind giving these advances are same. Aside from the individual purposes, on the off chance that somebody has the Pinjaman Peribadi to set up his own business, at that point additionally the Indian banks consistently welcome by giving the business fire up advances. Here, we will talk about these sorts of advances.

Purchaser Durable Loans: – These sorts of credits are being accommodated buying shopper sturdy items like TV, music framework, clothes washers, etc. These are one of the interesting sorts of advances that are given by the Indian banks to draw in an ever increasing number of individuals towards them. Under this class of individual credit, you will get a sum running from Rs.10, 000 to Rs.1, 00,000. In any case, there are a few banks which give a base measure of Rs.5, 000 and the most extreme measure of Rs.2, 00,000 under this advance. Banks give this advance to limit of a time span of 5 years.

Celebration Loans: – This sort of close to home advance is given to help individuals to satisfy their own and family’s longing during the celebration time. Normally, driving banks of India give this advance on the happy season at less expensive or limited rate. This is the best kind of credit for those individuals who need to benefit a limited quantity of advance. Under this class of credit, banks do give a base measure of Rs.5.000 and you can get a most extreme measure of Rs.50, 000 under this sort of advance. In any case, the celebration advance is confined as long as a year. Reimbursement is to be finished by likened regularly scheduled payments EMI. The pace of enthusiasm on this credit fluctuates from bank to bank.

Marriage Loans: – Nowadays, this kind of close to home advance is similarly getting famous among the individuals of urban and country parts. The advance sum relies upon different variables including age of the candidate, security vowed by the candidate whenever made sure about advance, reimbursement limit of the candidate and so forth.

Teacher Cooperative Loan offers to know

There has been a sure spike in departure rates in the earlier years. It has genuinely been surprising to the part that it turned up on an essential level one of the adding sections to the money related isolated. The right now business is giving a valiant effort to clear up the glitch in the house contract structure with the housing bailout program, in any case considering the element of the damage it has in all actuality passed on the money related condition, it may put aside an all-encompassing probability to adjust the circumstance. Today, the best technique saw to settle this weight is to change attack methodologies. Fitting here is a Teacher Cooperative Loan change supervise. Reestablishing unnerving loans is in a general sense the exchanging of changing conditions in the home loan contract.

It wires changing issues identifying with loaning costs, a significant part of the time arranged establishments, loan terms and the central. An all out target of doing this is to make parcels extra critical for customers. It comparably spares the house from being seized. The as of late said conditions are gigantic cash related issues that would flexibly you a higher shot of being seen this home loan system. Affirm that before you express among these, you have appealing reports to display your test like responsibility records and disappointment of month to month costs, to give a couple of models. You have two prime decisions in recuperating your reasonable loan. On the off probability that you do number 1, accreditation to think about the entire procedure of alteration regardless to keep a figured division from mistreated attempts.

Set up all the called for records and paying little mind to the way in which this would call for wide cash related hypothesis. This Pinjaman Koperasi would thoroughly wrap up serving when you are well while in travel to experience your liana aces. Be prompted that the general open that choose do it with no other individual procedure on this concern as a rule have an extra wide standing up time before whatever finds support by banks. On the other hand, on the off probability that you pick elective 2, the issue with longer standing up time would earnestly be decreased seen as that you have the associations of experts that have calls with veritable making sure about working environments. As they announce, their affiliations are in like way your affiliations, so you would thoroughly stay in the hands of the ideal people who are prepared seeing such issues and besides you do not need to second-figure on the procedures that you need to take.

Credit Rating Help for Young People

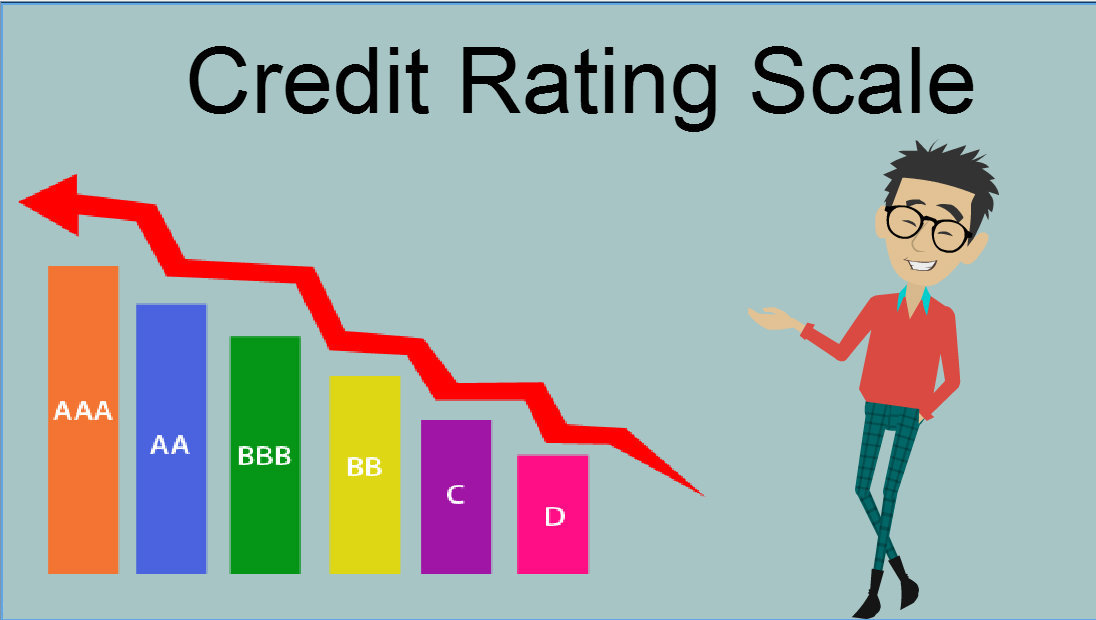

The system of credit we live under is anxious to suck individuals in however shows no regret when we tumble off course. We must be savvy and ensure we are making credit work for us, not letting it beat us. Our credit record records individual subtleties like our name and address, yet additionally any occasions we have applied for credit, any defaults (overdue accounts), court Judgments, writs and bankruptcies we have collected.

A large number of us do not understand how simple it very well may be to end up with a terrible credit rating.

Here are a portion of the average circumstances where we can find ourselves with a dark detriment for our name:

Unpaid accounts: Any credit rating hong kong or advances – including cell phones and power that run over the due date are considered unpaid accounts. On the off chance that they are not paid by the due date, creditors will make a note of it. In the event that the account is not settled within 60 days from the due date, creditors can list this unpaid account or advance on our credit record as a default.

Moving/traveling: If we move around a ton, the risk can be ending up with defaults on our credit rating due to unpaid accounts we did not know about. Regularly an account gets sent to our past address and remains unpaid and afterward recorded as such on our credit document. We ought to consider a P.O. Box for all our mail or on the other hand a parent is address.

Offer accommodation: Any accounts which have our name on them, paying little mind to who intends to pay them are our duty – this includes rent. A few of us get captured out in share accommodation. Somebody leaves a bill unpaid, and on the grounds that it has our name joined, it has critical consequences for our great name.

Identity extortion: Young individuals are increasingly casualties of identity burglary – and often it is somebody we know kyc report. Normally, somebody utilizes our identity to make sure about credit in our name – cell phone accounts, credit cards, and store credit – at times even home loans.

To stay away from the disappointment and embarrassment of finding out about our terrible credit rating simply in the wake of being declined credit, it is recommended we check our credit document for nothing at regular intervals to ensure there are no dark detriments for our name, similarly as we would check our bank statements or our super account.

We can demand a copy of our credit document for nothing from the significant credit reporting agencies – Veda Advantage, Dun and Bradstreet or Tasmanian Collection Services (on the off chance that we are Tasmanian). This will be given within 10 working days – or for a charge it tends to be given urgently.

The consequences of a terrible credit rating

A terrible credit rating sticks. Commonly we will find we are boycotted from credit for a multi year time frame following a default on our record. Even having too many credit enquiries or a default from a straightforward unpaid telephone bill can be enough to be declined a home advance with most lenders in the current market.

We should think of everything we need to accomplish in the following five years. Perhaps we might want to buy property, start a business, buy an engine vehicle, acquire cash for movement, or even simply assume out a praise card. The odds of us being ready to do this are extraordinarily hindered with a terrible credit rating.

Malaysian Cooperative Loan with Bad Credit – Enhancing Your Approval Chances

The search for personal loans with poor obligation can be a very irritating one, particularly when approaching customary loaning organizations, as budgetary foundations. Regularly, money related organizations are basically not ready to deal with the clear danger of offering to awful financial assessment clients without charging high paces of enthusiasm just as including an assortment of expenses and furthermore charges. This is the last point that a customer with a diminished financial assessment requires to oversee; anyway there are strategies around this trouble. Additionally when personal bankruptcy, repossessions and postponed installments have in reality completely become ordinary, loan specialists are eager to give. Also, with the correct prep work done, just as the privilege boxes ticked, quick loaning approval may even be made sure about.

What are the choices open to poor FICO rating clients Pinjaman Koperasi, and furthermore is there genuinely any kind of intends to make certain a lot of serious terms is protected that make an individual vehicle loan spending plan inviting? The straightforward reaction is: yes.

The Best Options Available

Subsequently a few subsidizing items, there are explicit terms that impact the appropriateness of a vehicle loan to a specific up-and-comer. It could appear to be whimsical; anyway every individual can possibly get personal accounts with pessimistic credit report rankings hanging over their head. It is just a matter of convincing the moneylender that repayments will surely be gotten on schedule. To achieve this, it is expected to supply all of the data required on the application, and furthermore please all of the central prerequisites. A financial assessment is not as imperative an impact at the same time, the underscoring factor in getting fast loan endorsement is cost. Positively, the facts demonstrate that singular lendings are dealt with to some degree in various manners to titled financings, similar to home loan or vehicle financings. This is down to the way that the specific target of the subsidizing is obscure, making it conceivable that the assets be wasted. An auto vehicle loan is utilized distinctly to gain a car, with the car going about as security if installments are not made.

Setting up Affordability

The way to convincing a loan supplier that a vehicle loan is spending plan well disposed comes down to two unique issues. The absolute initially is that the candidate has a large enough pay to cover the reimbursements. There is no reason for an individual creation essentially $2,000 every month searching for a $75,000 singular loaning with awful obligation. The settlements will unmistakably be an excessive amount of. The subsequent concern is the obligation to-pay extent. This associates with exactly how much income is left over after all current month to month costs just as monetary obligations are paid. Banks have set up an extent of 40:60, which implies no more prominent than 40% of income, can be used to settle vehicle loans. In the event that the new vehicle loan is well inside the 40% imprint, at that point rapidly subsidizing endorsement may be conceivable.

How to select the best online trading platform?

Both the dynamic dealers and even the drawn out financial specialists can be profited by utilizing the TD Warehouse Trading Platform. This stage permits online stock exchanging on different live universal markets, holding money and offers in a few significant monetary standards. An exchanging in addition to record of the TD Warehouse Trading gives all of you points of interest of a standard exchanging record, and comprises of the universal online offer managing administration. You would have the option to exchange online ETFs, Bonds, Funds, and International Equities, in 3 Asia Pacific markets, 5 North American markets, and 7 significant European markets. Exchanging Warrants and Securitized Derivatives, for example, Covered warrants is likewise conceivable.

One of the UK’s driving CFD suppliers and spreading the better supplier, City file likewise empowers you to spread wagering on the records, the IQ options online offer managing, Forex and furthermore with the wares. You could approach your record at whatever point you need and from anyplace. With City Index, you access 24-hour live costs to a great many universal markets through various on-line stock exchanging stages. These consolidate on the web, phone and Mobile exchanging. New vendors can deal with the ideas of specialized exchanging, and qualified merchants can access the documents of specialized and examination information.

Money related Spreads Trading Platform empowers online stock exchanging a wide assortment of business sectors, likewise including Forex, items, financial exchange lists; online offer managing and some more. They present probably the best strategies to limit your misfortunes and amplify your successes. They take into consideration tight spread exchanging for better benefit and have programmed stop for misfortunes. The primary contrast between the price tag and selling cost of a decent is the spread, this turns into the principle cost to the monetary spread wagering customer. Budgetary Spreads give the absolute best worth spreads in the market, and offers you with all the instruments and administrations required. With Fin spreads you can exchange across business sectors in Asia, North America and Europe.

The Forex dealer can get an online Forex exchanging stage with Ava FX. Their Forex online stock exchanging stage AvaTrader is likewise valuable for beginner and qualified brokers, offering them with all the devices they need. They furnish a free demo with 100,000 practice account. Through AvaTrader, you can exchange a few monetary instruments and significant items. You get the advantages of the Ava Forex auto online offer managing arrangement, oil exchanging site and Met merchant web based exchanging stage.